IBKR’s Edge

How Barriers to Entry Become Your Strategic Advantage in International Investing

In the ever-evolving world of global investing, the United States stock exchanges—primarily the NYSE and NASDAQ—stand as the undisputed titans, drawing companies worldwide with promises of unparalleled liquidity and capital access. Yet, for savvy investors, smaller markets like Australia’s ASX (Australian Securities Exchange) and Canada’s TSX (Toronto Stock Exchange) and TSXV (TSX Venture Exchange) offer intriguing strategic advantages. These exchanges, while dwarfed by their U.S. counterparts, create barriers to entry, fewer competitors, and currency plays that can supercharge long-term accumulation strategies. In this newsletter, we’ll dive deep into why these markets aren’t just alternatives—they’re smart plays for building outsized positions with reduced noise. We’ll also touch on essential tools like Interactive Brokers (IBKR) to get you trading seamlessly.

The US Stock Market: The Holy Grail of Liquidity

· Liquidity: NYSE and NASDAQ together boast average daily trading volumes exceeding $200 billion.

· Advantages for Companies: Easier fundraising through secondary offerings, broader analyst coverage, and a global investor base.

· Comparative Volumes:

o ASX daily volume: AUD 5-6 billion (USD 3.3-4 billion)

o TSX daily volume: CAD 7-8 billion (USD 5-5.7 billion)

o U.S. markets process over 40 times the volume of the ASX on a good day.

· Dual Listings: About 10% of Australian resource companies and over 210 Canadian firms pursue U.S. listings for greater capital access.

· Investor Opportunity: Exploit inefficiencies in home markets as companies chase U.S. listings.

The ASX: Barriers, Population Plays, and Currency Edges

· Market Structure: Over 2,200 listed companies, market cap of about AUD 2.5 trillion (USD 1.65 trillion).

· Entry Barrier: Minimum AUD 500 initial investment fosters a committed trader base.

· Population:

o Australia: 26 million people, 7.5 million ASX shareholders (29% participation rate)

o USA: 340 million people, 62% stock ownership (~210 million)

· Competition: Less competition for undervalued stocks, especially in mining.

· Arbitrage Opportunity: Dual-listed firms show price lags between ASX and U.S. exchanges.

Canadian Exchanges: TSX and TSXV – Small Pond, Big Fish

· Market Structure:

o TSX: 1,600+ listings, CAD 3.5 trillion market cap

o TSXV: 1,500 junior listings

· Flexible Entry: No rigid minimums, trades start at one share or board lot.

· Population & Ownership: 40 million people, 49% stock ownership (~20 million investors).

· Retail Flow: U.S. retail bought $3.4 trillion in equities in H1 2025; Canadian volumes much lower.

· Mispricing & Opportunity: Less competition on TSXV allows investors to build positions without crowd-driven spikes.

· Interlisted Plays: Examples include Enbridge (TSX: ENB, NYSE: ENB), with temporary discounts on TSX.

Leveling Up Your Trades: Why IBKR and How to Get Started

· Brokerage Solution: Interactive Brokers (IBKR) offers cross-border trading with low commissions and currency conversion at interbank rates.

· Platform Options:

o IBKR Desktop (full-featured platform)

· Advanced Features: API and mobile app for algorithmic trading, margin rates as low as 1.5%.

The New Frontier of Investing

Today’s markets are more connected than ever, with geopolitical shifts, technological disruptions, and economic divergences creating unprecedented opportunities across borders. Investors who want to stay ahead must look beyond their local exchanges and consider opportunities worldwide. Global market access isn’t just a luxury for institutions—it’s increasingly essential for active investors and traders seeking diversification, growth, and a competitive edge. Yet, the path to true global investing is often blocked by barriers: limited access, high costs, and complex regulations. This is where Interactive Brokers (IBKR) stands out, offering a seamless bridge to these opportunities while empowering users with cutting-edge tools to navigate volatility in real time.

Why Global Market Access Matters

· Emerging opportunities across borders due to technology and economic shifts

· Active investors need diversification and growth outside their home markets

· Traditional obstacles: limited access, high costs, complex regulations

What Is Interactive Brokers?

Interactive Brokers (IBKR) is a leading brokerage firm known for its global reach, powerful trading technology, and cost-effective solutions. Founded in 1978, IBKR serves over 4 million client accounts across more than 200 countries and territories as of October 1, 2025—a 32% increase year-over-year.

· Key statistics: 4M+ clients, $500B+ daily trade volume, 150+ exchanges

· Platform highlights: Desktop and mobile apps, advanced analytics, multi-currency accounts, AI-enhanced news feeds

· Download IBKR Desktop here, mobile app here

IBKR’s Advantages Over Traditional U.S. Trading Apps

· Global Market Access: Trade stocks, options, and futures in North America, Europe, Asia, and beyond, including niche venues

· Low Costs: Transparent commissions, no hidden FX conversion fees, competitive margin rates

· Advanced Tools: Real-time data, algorithmic trading, risk analytics, customizable dashboards

· Diverse User Base: Suitable for individuals, institutions, hedge funds, family offices

Traditional apps limit foreign access to ADRs or ETFs, which may be less liquid and more expensive.

The Downsides of OTC Stocks vs. Direct Foreign Exchange Trading

· Liquidity: OTC markets are thinly traded, with wider spreads

· Regulation: Less oversight, increased risk

· Tax Complications: Dividend treatment and withholding can be complex

· Currency Risk: Hidden conversion fees and volatility

OTC foreign stocks underperform direct listings by 3-5% annually due to these frictions.

Special Benefits of Primary Exchange Ownership vs. OTC

· Rights Offerings and Warrants: Eligibility for discounted share purchases during capital raises

· Voting Rights and Dividends: Full voting privileges and dividends in local currency

· Better Liquidity and Pricing: Higher trading volumes and narrower spreads

· Tax and Regulatory Perks: Treaty benefits and direct participation in corporate events

· Long-term Compounding: Rights issues can boost stakes at favorable prices

Direct access via IBKR means better pricing, full rights, and streamlined tax handling.

The Power of Competitive Advantage in Investing—And How IBKR Delivers It

· Access: Direct access to major and emerging global markets

· Information: Real-time feeds and analytics for global securities

· Cost Efficiency: Low commissions, transparent FX rates, scalable margin lending

IBKR allows early positioning in global markets, capturing growth before trends become crowded.

Barriers to Entry: Building Big Positions Without the Crowd

· U.S. markets are saturated; finding an edge is tough

· Australia and Canada offer unique opportunities with lower participation and less competition

· ASX: $500 minimum investment, smaller trader pool

· TSX/TSXV: Lower intensity, shallower liquidity pools

· Currency dynamics (AUD/CAD) can amplify USD returns

IBKR overcomes these hurdles with:

· Single Account Structure: Access global markets with one login

· Multi-Currency Funding: Hold and convert dozens of currencies, earn interest

· Global Account Management: Manage positions and FX from one dashboard

· Direct Ownership: Buy shares on local exchanges for full benefits

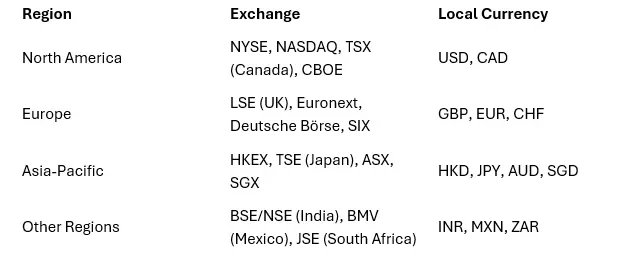

Stock Exchanges Available on IBKR

Use IBKR’s Basket Trader to build custom portfolios across exchanges.

Conclusion and Call to Action

Global investing is no longer a privilege—it’s an essential strategy for those seeking growth and diversification in 2025’s multipolar world. Interactive Brokers empowers investors to break through barriers, access new markets like the less-crowded ASX and TSX, and manage risk efficiently with industry-leading tools and global reach. Whether you’re an active trader or a professional institution, IBKR offers the access, information, and cost efficiency you need to unlock global edges—and turn currency weaknesses into portfolio strengths.

Ready to explore new markets? Consider Interactive Brokers as your gateway to global investing. Visit interactivebrokers.com to learn more and open an account. Securely download the platforms: Desktop or Mobile.

Final Thoughts: Play the Edges, Not the Crowd

While U.S. exchanges remain the liquidity beacon, ASX and Canadian markets offer a quieter arena for alpha: Entry barriers, sparse competition from smaller trader pools, and favorable FX dynamics. In a world where 165 million global retail investors chase the same U.S. headlines, these under-the-radar venues let you stack wins methodically. Dig into sectors like Aussie lithium or Canadian cleantech—your portfolio will thank you.

Upgrade to paid and unlock the companies we love with handpicked mining companies, energy plays and much more. With full breakdown and why they are great companies. Answering the unknown questions before they become answers.